Our client is an authorized Business Correspondent to multiple Banks and Non-Banking Financial Companies (NBFC’s) in India. They are engaged in providing micro-loans under the SHG /JLG model, credit-linked insurance, individual and group-based savings accounts on behalf of their banking partners.They provide financial products and services in a reliable, cost-effective, and transparent manner.

Manual cash handling processes increased the risk of errors, theft, and inefficiencies in financial management, hindering overall operational effectiveness.

Organizing a large customer base and planning collections from them efficiently was not possible for them, leading to potential oversight of customers and loss.

The existing collection app encountered difficulties in storing, sorting, and securing vast amounts of customer data and financial data and transactions.

Maintaining a positive customer relationship while also recovering a debt is a delicate balance. They were facing the challenge of balancing customer relationships with recovery. Businesses risk financial loss from defaults and underwriting issue.

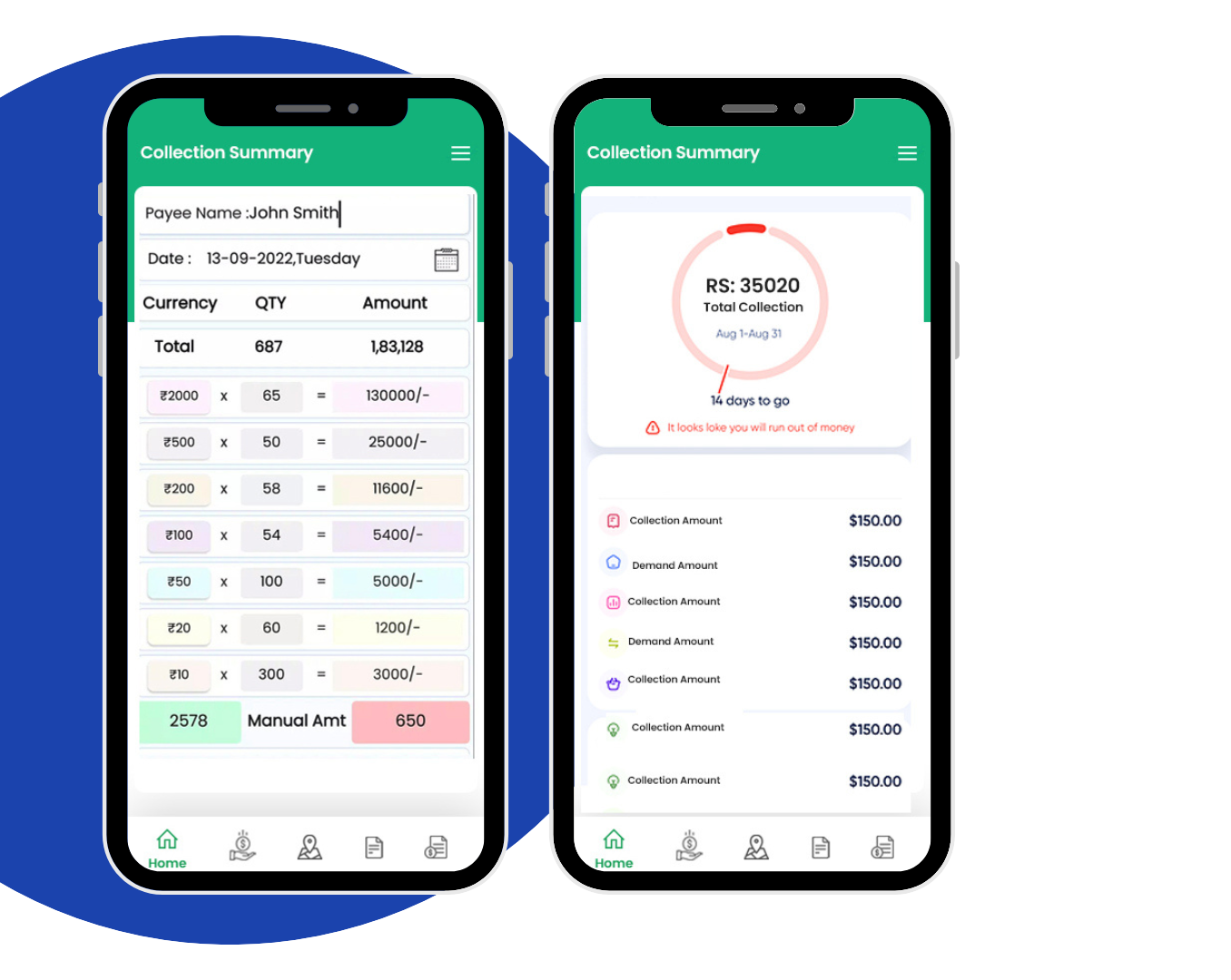

ROs can mark attendance and view member details, including account ID, EMI amount, OD amount, and total demand.

Options for cashless payments via QR code or payment link are available, along with auto-populated customer details.

ROs can handle partial payments and provide reasons for unpaid amounts, with options for future payment arrangements.

A summary page displays key metrics such as attendance, demand, collected amounts, and savings, providing a comprehensive overview of collections.

Upon final submission, the submitted group is marked for tracking and follow-up, enhancing accountability and workflow management.

The OD collection section allows ROs to monitor live OD details of customers and centers mapped to them, facilitating timely interventions.

Users can filter and search for specific OD data, streamlining the management of overdue accounts.

The deposit section enables ROs to record cash collections, deposit details, and capture images of receipts for verification.

Various deposit options are available, including deposit through BC points, direct bank deposits, handing over cash to branch managers, and locating nearby deposition points for convenience.

This report track promises made for payment and can be used to predict recovery chances. These reports also help in prioritizing follow-ups as well as identifying trends in compliance with promises made for payment.

OD reports helps to keep a track and prioritize collections by showing where accounts are overdue and trends in overdue accounts

This report summarizes the total cash received during specific periods which are yet to be checked and verified the loan facilitating financial institution.

CE performance reports can help in evaluating collection executive's performance and efficiency with addition to recovery rates.

The DCR ratio assesses a company's ability to repay debts with operating cash flow, indicating its financial health and risk profile for lenders and investors.

The dashboard displays a calendar and a menu with details of the RO and sections for updating member details, checking loan utilization, viewing deposit logs, and logging out.

The dashboard provided insights into regular collection and overdraft (OD) collection, with detailed cards for scheduled tasks, demand, collected amounts, and savings.

A navigation panel at the bottom of the dashboard offered functions such as Navigate to Home, Money Deposit, Hotspot, E-receipt, and Statement of Account.

Regular collection and OD collection tabs were available for easy navigation.

Users can search for members and filter results based on various criteria.

Details of centers and groups within each center are accessible, allowing ROs to manage attendance and collect payments efficiently.

A central dashboard provided a calendar, menu, collection overview, and navigation panel for easy access to features like member details, loan utilization, deposit logs, and statements.

Discrete tabs for regular and overdraft (OD) collections offered search and filter functionality, allowing for efficient navigation, member management, and attendance tracking.

The member details page allowed collection agents (ROs) to mark attendance, view details like account ID and loan amounts, process cashless payments via QR code or payment link, and manage partial payments.

A dedicated summary page displayed key metrics and facilitated final submission for tracking and follow-up, enhancing accountability and workflow management.

The OD collection section provided live views of customer and center OD details (overdue amounts), facilitating timely interventions by ROs. Users could filter and search for specific OD data.

Fill out this form for booking a consultant advising session.

We use cookies to enhance your user experience. By continuing to browse, you hereby agree to the use of cookies. To know more; visit our Privacy Policy & Cookies Policy

X